Key Takeaways

- Purchasing an upper-fixer home is an opportunity to buy a property at a lower price and customize it to your preferences.

- Planning your home renovation journey involves setting realistic budgets and timelines and deciding between DIY and professional contractors.

- Mitigating common risks with fixer-uppers requires conducting a home inspection and being prepared for unexpected issues during repairs and renovations.

Overview

Buying a new house is exciting. But do you know what it also is? Costly! Take the example of Alan, an IT guy making around $100,000 annually in the US who was looking to buy a home. He searched his locality and vicinity for a month only to realize that a new home was beyond what he could afford.

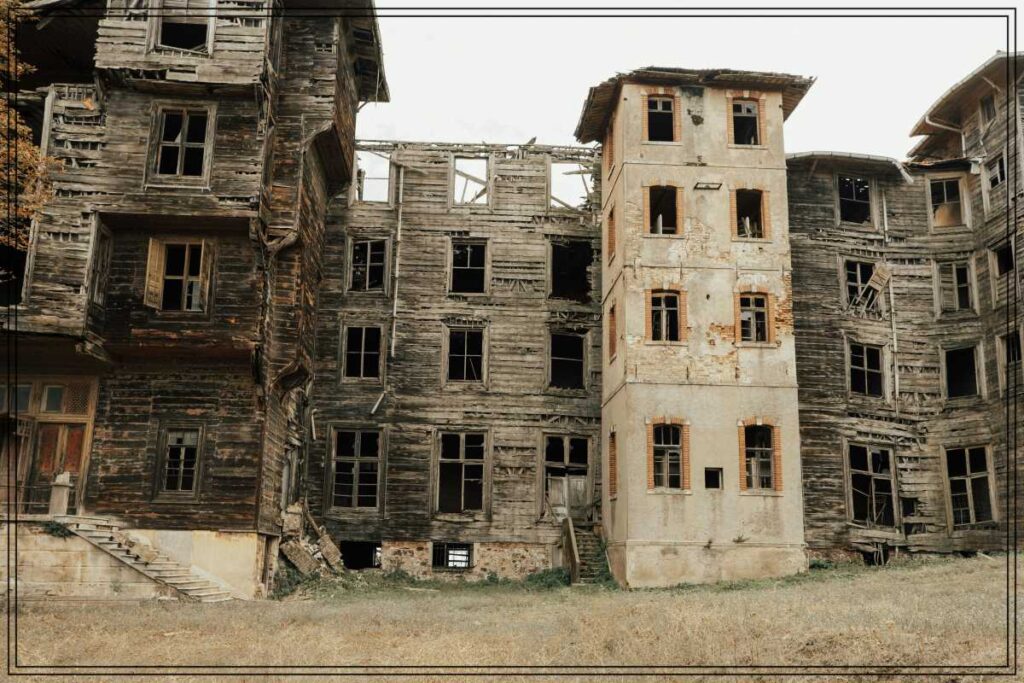

Image Source – Pexels

While researching, Alan also found several old homes which were uninhabitable in their current condition, but significant repair renovations could make them the dream homes that people would love.

So, Alan bought one of the fixer-upper homes near his office at a dirt-cheap price and started working on it. After a few months and a lot of renovation work, the dilapidated site was converted into something that he could label as his ‘dream home.’ When asked how he felt about it and if the experience was worth it, he quickly acknowledged that it was laborious but the outcome is significantly cheaper than what he would get for the money he shelled.

What is a Fixer-upper House?

A fixer-upper home is a property that requires major renovations and repairs for it to be considered ‘livable.’ It is probably older and may need time and money to improve its structural and cosmetic imperfections. While these are mostly available at low prices, the repair and renovation costs are often difficult to ascertain upfront.

Because of these uncertainties, a bargain can become a money burner in no time. It’s why most people stay away from fixer-upper homes, but if you get it right, the result can be admiring and worth the additional effort.

How to Pick a Fixer-upper Home?

Knowing a local real estate agent or realtor can make it easier to find the right fixer upper house for sale. You can also attend auctions to pick up a foreclosed home (a house seized by the lender), but those have to be picked up as they are, which can prove risky. Online forums that list fixer-upper properties in your choice of localities is another option that many homebuyers use.

There are many fixer-upper house shows on HGTV, but you have most likely come across a show titled ‘Fixer Upper, ’ famously hosted by Chip and Joanna Gaines. Most GenZ learned about fixer-upper houses from it, but these shows often show only a part of the process and elude you from the actual work that goes behind converting a fixer-upper home to a livable one.

So, here are five invaluable tips to mellow down the challenges it presents –

Set your Budget Right

As per NAR (National Association of Realtors), the median home value in the States stood at $396,100 in July 2023. The number may be beyond a middle-class American and that’s why they opt for cheaper alternatives such as fixer-upper homes.

Before setting foot in the world of fixer-uppers, you must know the monetary ballgame you are willing to invest. Create a budget that should encompass the home’s purchase price, repair costs, and any outflow for revamping the property.

Remember that fixing a property is a cumbersome job that will require time and money. Given the project’s intricacy, timelines can get messed up easily, stretching your budget. Factors beyond your control, such as inappropriate weather or delays in permits, can also cause the budget to go haywire if not done right.

So, one of the best ways to set your budget right is to accommodate the unexpected. In most cases, adding 20% to your existing home-buying expenses for ancillaries should keep you in good stead.

In addition, you can choose between DIY or professional contractors for your renovation needs. Assess your skill levels and consider brushing up on your skills. These days, you can learn a lot for free on YouTube, and there are many DIY tutorials across the internet. Use these skills to save money and spend it on something more meaningful.

Focus on the Location First and the House Second

You can fix a home, but its locality is fixed. So, if parts of your locality are shabby or its property values are unreasonably low, it can be a red flag. How to get around it? The best way to deal with it is to focus on the location first. Look for desirable neighborhoods that align with your preferences and lifestyle, and take a walk down their lanes to find potential homes. When you find one, ascertain if it’s an odd one out or if the entire locality looks the same.

Another way to find a great deal is to look for fixer-uppers online via platforms and apps like Zillow. Look for homes with descriptions that you can associate with a fixer upper homes for sale, such as “build your dream home” or “come with a contractor.” Have a list of potential options and group them location-wise before paying a visit.

Go for a Full Survey and Use it to Bargain

When you are buying a new home, you usually know what to expect. It is quite the opposite with fixer-uppers. Unless you are an expert yourself, it would be difficult for you to figure out structural and other issues with the property you are looking to buy. It is also important that cosmetic issues should not deter you from buying a home that has a firm foundation and is easy to fix.

For example, you can fix issues like tarnished paint and outdated doors and windows. The core focus should be on the property’s structural strength, which includes aspects like HVAC (heating, ventilation, and air conditioning), foundation, electrical system, and moisture incursion.

Opting for a full survey makes more sense, as it will highlight areas that you may not have considered. Once you have the results, use them to make changes to the budget and negotiate with the seller to get a more affordable price.

Limit your Mortgage

According to NAR, 12% of home buyers’ primary reason for buying a home was mortgage finance options. Needless to say, mortgages play a major role in homebuying endeavors.

If you are a first-time homebuyer, a mortgage loan for your newest purchase is probably the most obvious choice. If you are unsure of how to go about it, you can follow the two most commonly used thumb rules to determine the loan amount.

The first rule is the annual salary rule. It recommends limiting the total mortgage amount to three times your yearly salary. For example, if your family is making roughly $100,000 per annum, limiting the home purchase to a maximum of $300,000 is a safe bet.

The second rule is the 28% monthly income rule. It suggests that your monthly mortgage payment should be limited to 28% of your household’s gross monthly income. For example, if your family earns $10,000 monthly, the monthly mortgage payment should be at most $2,800.

Bifurcate Renovation in Phases

As per Coldwell Banker, 80% of home buyers prefer moving into a move-in-ready house over a fixer-upper, and it is easy to guess why.

Buying a fixer-upper and renovating it is sure to disrupt your life. Converting a fixer-upper into a dream home requires meticulous planning and execution. Beyond that, it requires time (and can span several months) and money. If you already have a house to live in, then the stretch isn’t an issue, but if not, bifurcating the renovation in phases can be an idea worth exploring.

While structural improvements are essential and require immediate attention, can you postpone certain home improvements, such as a dated bedroom, for some months. That way, you can have more funds to allocate or can use your property’s equity to design something even better than previously planned.

Transforming a Fixer-upper into your Dream Home is Daunting and Rewarding

The journey from dreaming about having a dream home to actually having it is one of a kind, especially if it’s your first home. While buying it is inadvertently the easier choice, opting for a fixer-upper can save you money, provided you are able to get your choices right.

The key is to be realistic about your choice and the kind of work you can undertake post-purchase. Once you have done the homework and are ready to build the dream project, put on your research hat and go out for a stroll!

FAQs

Where to find the best fixer-uppers in the US?

As per a Frontdoor study, here are the locations with the most upper-fixer options in the USA –

- New Orleans

- Albany, N.Y.

- Cleveland

- Memphis, Tenn.

- Newark, N.J.

- Anchorage, Alaska

- Aurora, Colo.

- Dover, Del.

- Detroit

- Milwaukee